| Mortgage term | Mortgage amortization | |

| Description | The length of time you are committed to a mortgage rate, lender, and conditions set out by the lender. |

The length of time if takes you to pay off your entire mortgage. |

| Time frame | 6 months - 10 years | CMHC-insured mortgage: Maximum 25 years Non CMHC-insured mortgage: 35-40 years (lender dependent) |

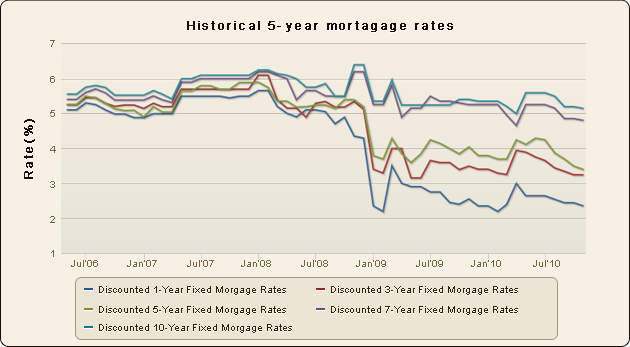

The mortgage term is the length of time you commit to the mortgage rate, lender, and associated mortgage terms and conditions. The term you choose will have a direct effect on your mortgage rate, with short terms historically proven to be lower than long-term mortgage rates. The term acts like a 'reset' button on a mortgage. When the term is up, you must renew your mortgage on the remaining principle, at a new rate available at the end of the term.

Source: Bank of Canada, 5-year mortgage rate

The mortgage amortization period, on the other hand, is the length of time it will take you to pay off your entire mortgage. The maximum amortization period in Canada is 35 years; however on July 9th 2012, the maximum amortization period on CMHC insured mortgages will be reduced to 25 years. Longer amortization periods reduce your monthly payments, as you are paying your mortgage off over a greater number of years. However, you will pay more interest over the life of the mortgage.

In June 2012, Minister Flaherty announced that the maximum amortization period on all CMHC insured homes would be reduced from 30 to 25 years. CMHC insurance is required on all home purchases with a down payment of 20% or less. Therefore, if you are putting more than 20% down on your purchase, some lenders may accept an amortization period of greater than 30 years.

Prior to this, on March 18th 2011, the maximum amortization on CMHC insured mortgages was reduced from 25 to 20 years.

Many home buyers choose shorter amortization periods resulting in higher monthly payments if they can afford to do so, knowing that it promotes positive saving behaviour and reduces the total interest payable. For example, let us consider a $300,000 mortgage, and compare a 25-year versus 30-year amortization period.

Scenario A |

Scenario B |

Difference (Scenario B-A) |

|

| Mortgage amount | $300,000 | $300,000 | - |

| Amortization period | 25 years | 30 years | - |

| Interest rate | 5.1% | 5.1% | - |

| Monthly payment | $1,762 | $1,620 | ($142) |

| Total interest | $228,580 | $339,659 | $111,079 |

The mortgage payments under scenario B are smaller each month, but the home owner will make monthly payments for 5 additional years. The total interest saved by going with a shorter amortization period exceeds $100,000.

For the savvy investor, these savings should be compared to the opportunity cost of other investments. Using the example above, the monthly savings of $142 under scenario B, could be invested elsewhere, and, depending on the rate of return, could come out ahead after 35 years.

Prepayment privileges set out by your lender will determine whether you can shorten your amortization period, by either increasing your regular monthly payments and/or putting lump sum payments towards the principal, without penalty. However, beyond these privileges, you will often incur costly penalties for making additional payments. According to the Canadian Association of Mortgage Professionals, 24% of Canadians took advantage of prepayment options in 2009.

| Age group | ||||

|---|---|---|---|---|

| 18-34 | 35-54 | 55+ | All ages | |

| 1 year term | 5% | 7% | 6% | 6% |

| 2-4 year term | 27% | 18% | 12% | 20% |

| 5 year term | 66% | 65% | 69% | 66% |

| 6-10 year term | 3% | 9% | 10% | 7% |

| >10 year term | 0 | 0 | 2% | 1% |

Source: Canadian Association of Accredited Mortgage Professionals (CAAMP) Fall 2010 Consumer Report

A 5-year mortgage term, at 66% of all mortgages, is by far the most common duration. A further breakdown shows that an additional 8% of mortgages have terms exceeding five years, while 26% of mortgages have shorter terms, including 6% with one year or less and 20% with terms from one year to less than four years.

| Type of purchase |

||

|---|---|---|

| New purchase |

All mortgages |

|

| Up to 25 years |

58% | 78% |

| 30 years |

12% | 8% |

| 35 years |

30% | 8% |

| 40 years |

0% | 6% |

Source: Canadian Association of Accredited Mortgage Professionals (CAAMP) Fall 2010 Consumer Report

The most common mortgage amortization period, on the other hand, is 25 years. However, 42% of new mortgages had amortization periods exceeding 25 years. This is an interesting observation considering amortization periods were only extended to 35 years in 2006.1 Beginning March 18th 2011, the maximum amortization period on all CMHC insured homes will be reduced from 35 to 30 years.

[1] CAAMP Fall 2010 Consumer Report

[2] Mortgage amortization period reduced to 30 years on CMHC insured mortgages as of March 18th, 2011

|

|

| Main Branch: 255 Duncan Mill Road, Unit 702 Toronto ON, M3B 3H9 | Tel: 416.222.3222 Fax: 416.222.3228 |

| Mississauga Branch: 333 Dundas Street, E. Suite#210 Mississauga, Ontario, L5A 1X1 | Tel: 905.232.7575 Fax: 905.232.7574 |